Financial Mentor

By Dave Gemmell

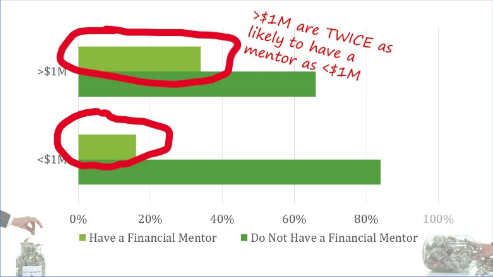

A survey of Adventist Pastors revealed eight different factors that may allow pastors to retire as millionaires. In this Best Practices series, I’ll be sharing each of these eight factors in bite-size pieces. Coming in at number seven in correlation strength is ‘Those whose net worth is anticipated to be over one million are more likely to have a financial mentor than those whose net worth is anticipated to be less than a million’(see bar graph).

Twice as many folks in the >$1M plus category have financial mentors than those in the <$1M category. What if more pastors took advantage of a financial mentor? As Pastors, we sometimes fool ourselves into thinking we already know everything about finances. When we realize we aren’t omniscient and turn to mentors we find they can make a huge difference as we navigate the unique pastoral financial landscape.

Personally, I turned a corner in my finances when I discovered that a couple of my friends were really good at finances. I was brave enough to ask them about their finances and they were delighted to share. I talk with them several times a year about my unique financial needs, and they have opened the door to things I never dreamed were possible. Here are some qualities you should be looking for as you consider possible mentors:

Make sure they understand the unique finances of the pastor

Find someone who has done well with their own finances.

Avoid people who are financially compensated by your relationship

Other pastors are sometimes the best.

The survey revealed that there are plenty of pastors who do well with personal finance. At least 25 out of 320 in this survey anticipate that their net worth at retirement will be greater than 5 million!

One of the best resources for those who participate in the NAD Retirement plan is a certified financial planner. This service is included at no cost to the participant. I can personally vouch for this service. This summer my wife and I were blessed by online consultation. In the first appointment, we went through all our finances and my unique questions. The certified financial planner put all our unique data into the software along with an almost infinite amount of variables to create the most likely best scenario for us. A month later the financial planner shared the results. The highly detailed report pointed to several things we should do to increase the likelihood of a good retirement outcome. At no time did the financial planner try to direct us to financial products that would benefit her company. The best part of the consultation for us is confirmation that our financial preparation in the 43 years I worked for the church allowed us to retire without financial stress. I highly recommend this service.

As pastors we need every break we can get, and having a financial mentor increases our odds of financial security in retirement.

Author’s note: These articles are condensed from the full report of the study that was presented at the 2022 CALLED Pastors’ Family Convention and can be downloaded here: If you would like to dialogue with the author you can email him at davegemmell@gmail.com.

Dave Gemmell recently retired from NAD Ministerial and is enjoying spending more time with his family, especially his three grandsons.